SBI CARDS

QUEUE MANAGEMENT SYSTEM

Service design case study

Overview

SBI Cards was seeking to implement a queue management system across its retail branches to better organize customer flow and improve the efficiency of the customer journey. By implementing this system, SBI Card management could better manage the customer experience at all of its branches nationwide, streamlining processes and enhancing customer satisfaction.The Challenge

SBI Cards faced a challenge in serving the approximately 43% of their customers who are part of the Gen X demographic, as these users often preferred to resolve their queries offline by visiting a bank branch and speaking with a customer relationship manager. However, not all SBI banks had dedicated teams for SBI Cards, which led to long queues and frustration for all customers.Research

Stakeholders Interview

As a freelance UX consultant for SBI Cards, I recently had the opportunity to meet with the stakeholders to identify the current problems and pain points with our credit card holders. Through the stakeholder interviews, we were able to identify a number of key issues that were affecting the customer experience. These includedLong wait times:

One of the most common complaints among customers is long wait times at branches, which can be frustrating and lead to a negative customer experience.Limited services:

Some branches may not offer all of the services that customers need, such as loan applications or credit card services, which can be inconvenient and require customers to go to multiple branches.Poorly trained staff:

Customers may encounter staff who are not knowledgeable or helpful, which can lead to frustration and a negative experience."There was an urgent need for a management system to address the needs of credit card customers."

Problems With Current Queue Management System

The lack of a dedicated queue for credit card customers was causing long wait times for all bank customers. Many credit card users were also resorting to approaching bank relationship managers for their queries and complaints, further adding to the wait time for other customers.

Strategy

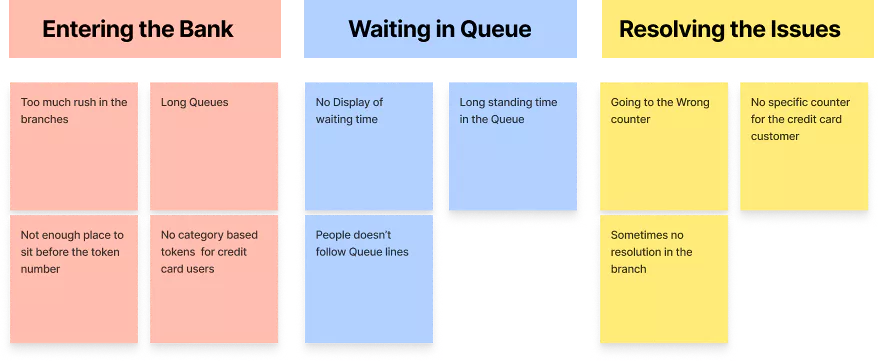

Affinity map

To better understand the issues faced by credit card users, we thoroughly reviewed the pain points and complaints expressed by stakeholders. Using affinity mapping, we organized these issues into categories to gain a deeper understanding of the problems at hand. This enabled us to identify and address areas where we could improve the customer journey and enhance the user experience.

Defining the problem

Through our research and affinity mapping, we identified several key problems faced by credit card customers, including: No specific customer relationship manager for credit cards No Separate Queue for Credit card customers No separate Token system for the Credit card customers Customers don’t know the estimated waiting timeDesign

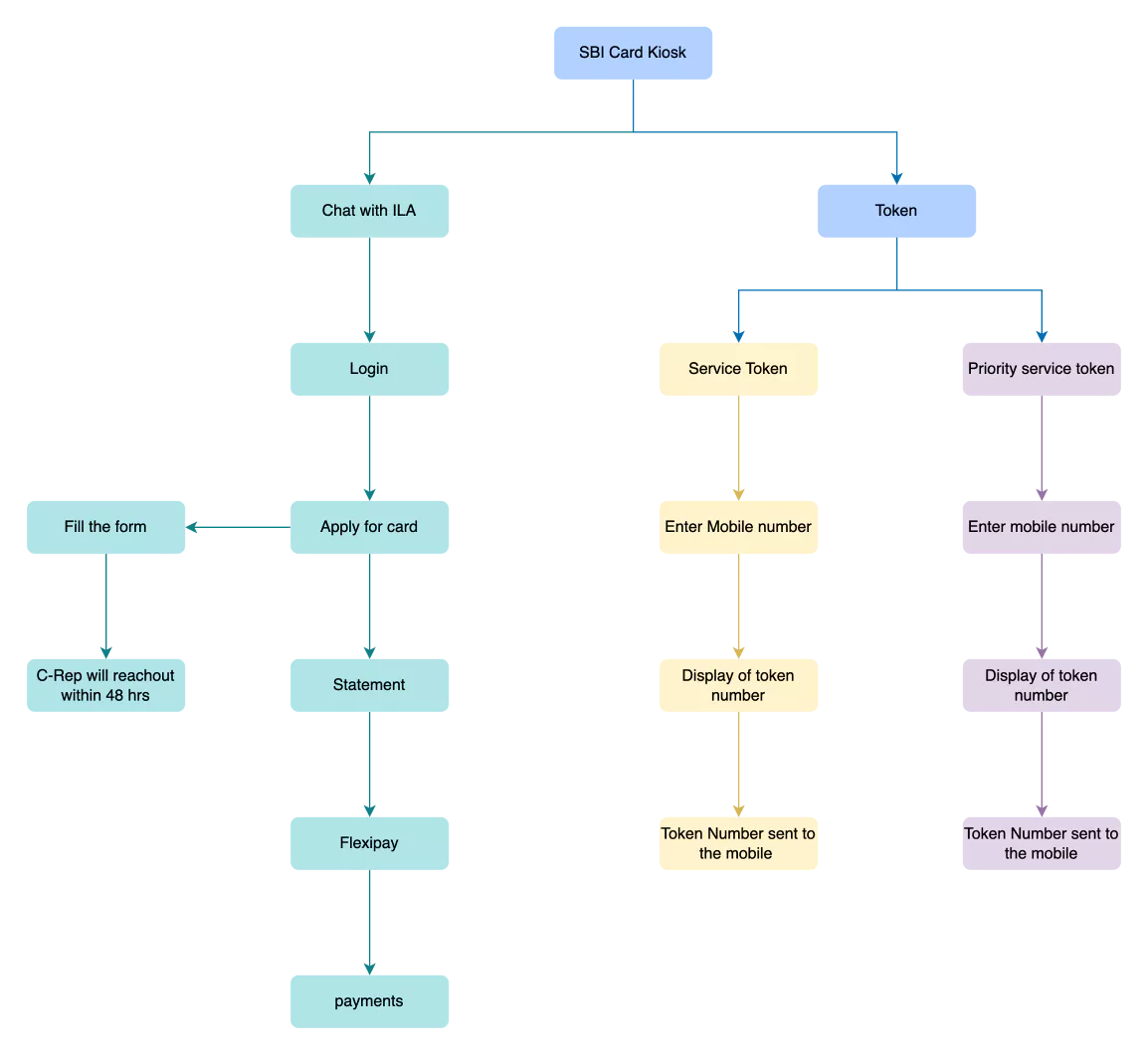

To enhance the customer journey and address the issues identified

through our research, we implemented a solution that combines the

token kiosk with the SBI Ila feature from the mobile application.

This allowed us to automate certain features for users and reduce

wait times, ultimately improving the overall customer experience.

Customer Journey

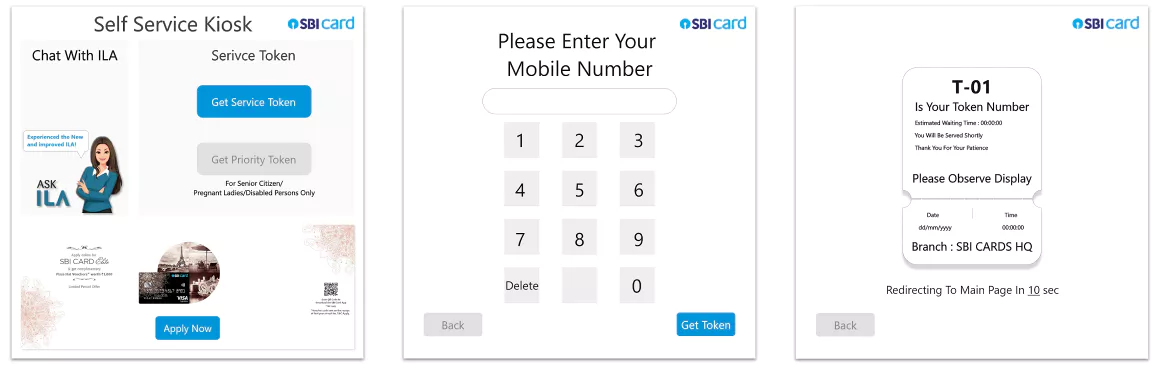

On Priority Service

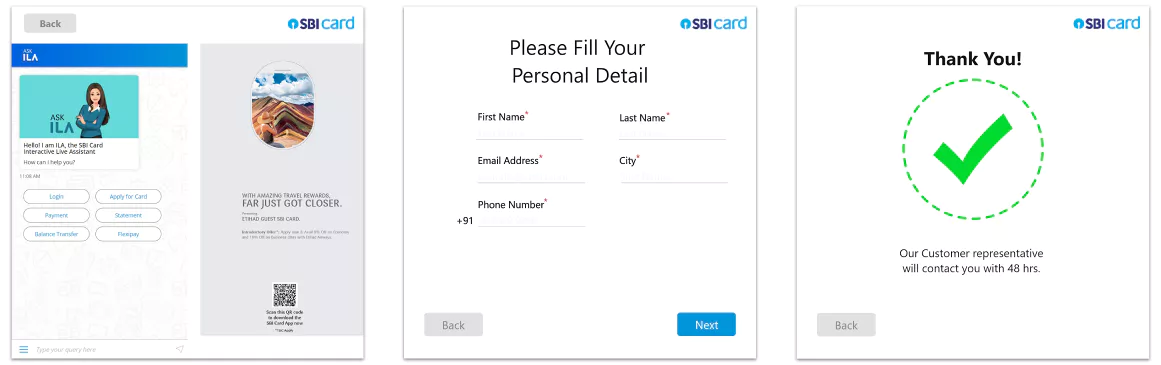

To ensure that all customers receive the attention they need, we recognized the need for a priority service token for special cases such as senior citizens, physically challenged individuals, and pregnant ladies. In addition to the normal queue tokens, we added a priority token to cater to these special needs and ensure that all customers receive the support they require.Using ILA to Digitalize Some Features

To encourage more customers to use digital channels for credit card services like new applications, bill payments, and statements, we decided to leverage the familiar SBI AI chatbot ILA. This would allow us to offer these services online, even to the Gen X customers who may prefer to resolve their queries and issues offline. By digitalizing these processes with ILA, we hoped to improve efficiency and convenience for our customers.Token Number On Mobile

To help customers keep track of their place in the queue, we implemented a system that sends an SMS to their mobile number once they have generated a token. This allows them to easily reference their token number and verify it against the display area, ensuring that they don't lose their place in line.Visual Design

To support the new customer journey, we created a new UI design for the kiosk. This design incorporated elements of the customer journey, such as the ability to take a token online and come to the bank at the estimated time, as well as features like the SBI ILA chatbot for digital credit card services. While designing the UI for the kiosk, we faced the constraint of SBI

ILA not being able to go full screen. To make the most of the

available screen real estate, we decided to use the remaining space

for marketing and advertisements. This allowed us to generate a

secondary income while still incorporating the SBI ILA chatbot into

the kiosk design.

While designing the UI for the kiosk, we faced the constraint of SBI

ILA not being able to go full screen. To make the most of the

available screen real estate, we decided to use the remaining space

for marketing and advertisements. This allowed us to generate a

secondary income while still incorporating the SBI ILA chatbot into

the kiosk design.